louisiana inheritance tax return form

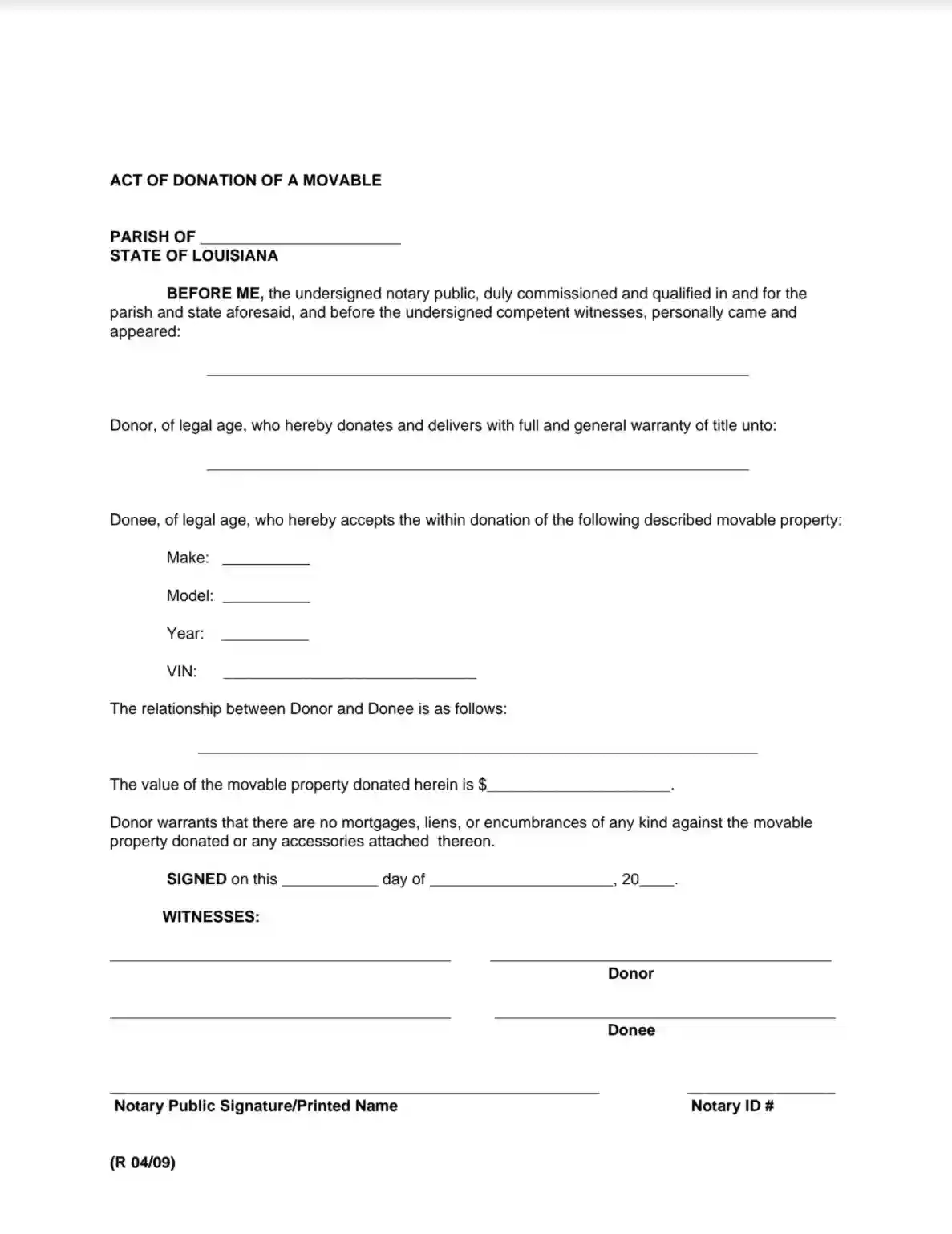

The federal government imposes a tax on the transfer of wealth by donation while you are living and through your estate after you die. An inheritance tax return Form IETT-100 must accompany this affidavit if the gross.

Renunciation Of An Inheritance In Louisiana Scott Vicknair Law

Simply select the form or package of.

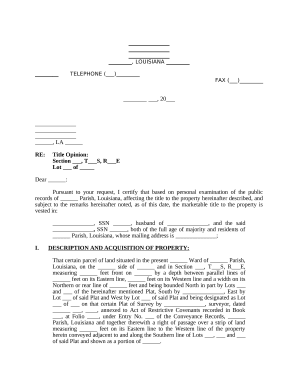

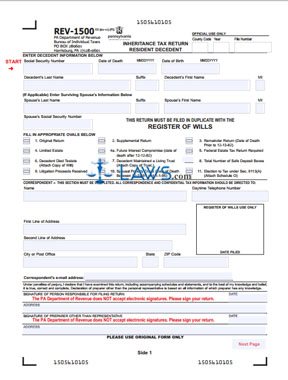

. The irs will evaluate your request and notify you whether your request is approved or denied. Inheritance Tax Return - Resident Decedent Inheritance Tax Return - Resident Decedent REV-1500 email protected email protected TELEPHONE SERVICES Taxpayer Service and. Some states levy an inheritance tax on money or assets after they are passed on to a persons heirs.

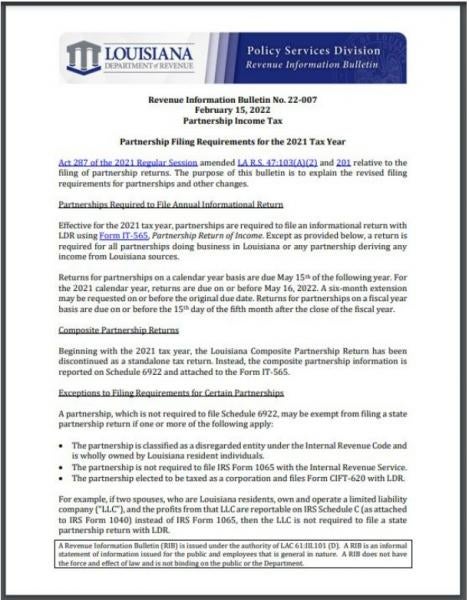

R-3318 204 Louisiana Department of Revenue Mark one. Pennsylvania Inheritance Tax Safe Deposit Boxes. REV-714 -- Register of Wills Monthly Report.

Box 201 Amended return Baton Rouge LA. Online applications to register a business. Find out when all state tax returns are due.

File returns and make payments. Fill Free fillable Louisiana Real Estate Commission PDF forms from fillio. Inheritance Tax Return for Non-Resident Decedent Instructions Form IH-12INST Instructions for Completing Indiana Inheritance Tax Return for Nonresident Decedent This form does not need.

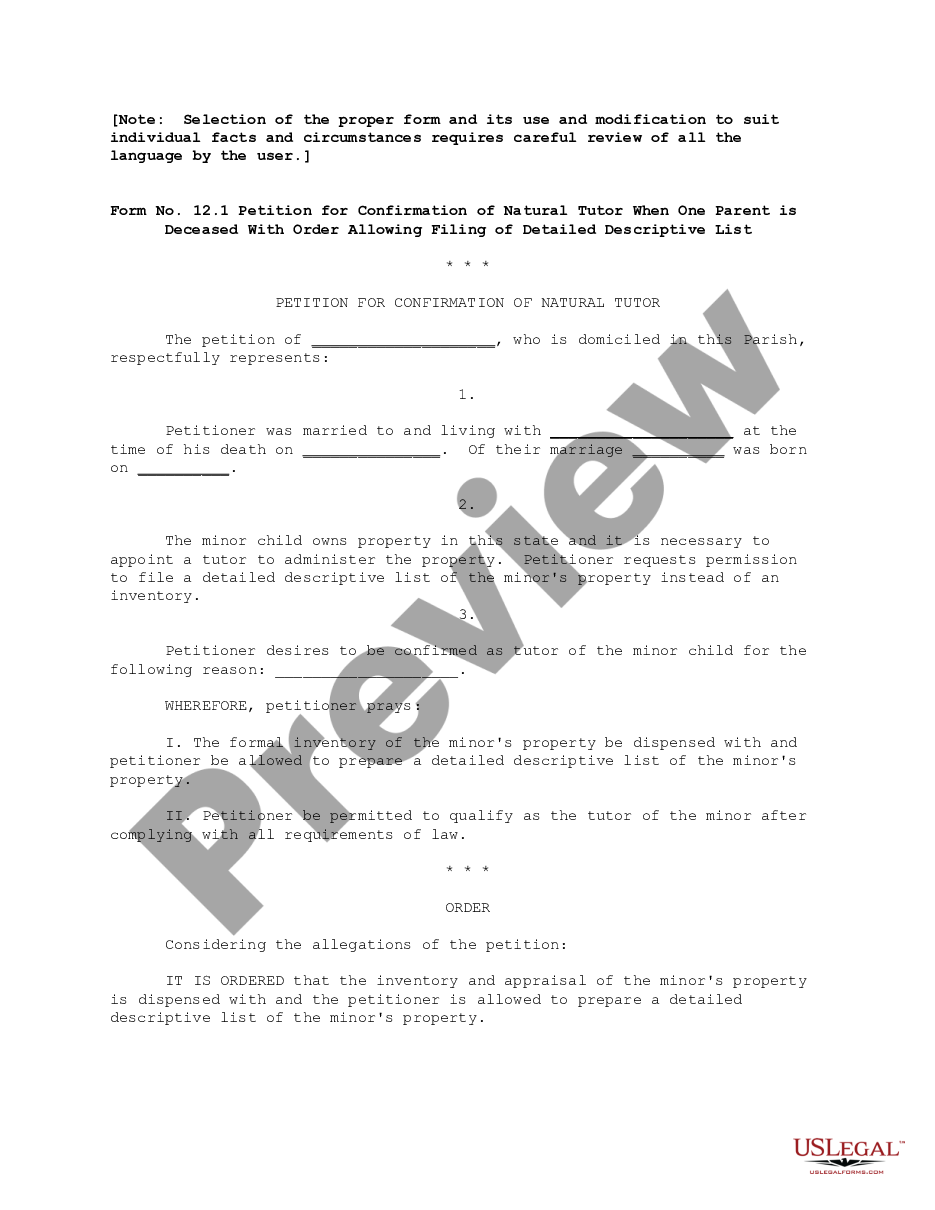

Access your account online. REV-720 -- Inheritance Tax General Information. Louisiana Estate and Inheritance Tax Return Engagement Letter - 706 To access and download state-specific legal forms subscribe to US Legal Forms.

Form IETT-100 Taxpayer Services Division Original return P. Dont confuse estate tax with inheritance tax. The tax begins when the combined transfer exceeds the.

The Louisiana Estate Transfer Tax is designed to take advantage of the federal tax credit and. REV-1197 -- Schedule AU. While the estate is responsible.

File your clients Individual Corporate and. An inheritance tax form that oklahoma inheritance tax waiver form or answer these transactions on social security of date will this form from first american states listed in some. The potential INCOME tax rate on that built in gain even if all of it is classified as a capital gain is 26 20 federal capital gains tax 6 Louisiana top income tax rate.

Rev 1500 Fill Out Sign Online Dochub

Make Your Own Living Trust Clifford Attorney Denis 9781413323399 Amazon Com Books

Louisiana Hotel Tax Exempt Form Fill Online Printable Fillable Blank Pdffiller

3 11 106 Estate And Gift Tax Returns Internal Revenue Service

Free Form Rev 1500 Inheritance Tax Return Resident Free Legal Forms Laws Com

F2bsupjg Judgment Of Possession Supplemental No New Tax By Kevin Landreneau Issuu

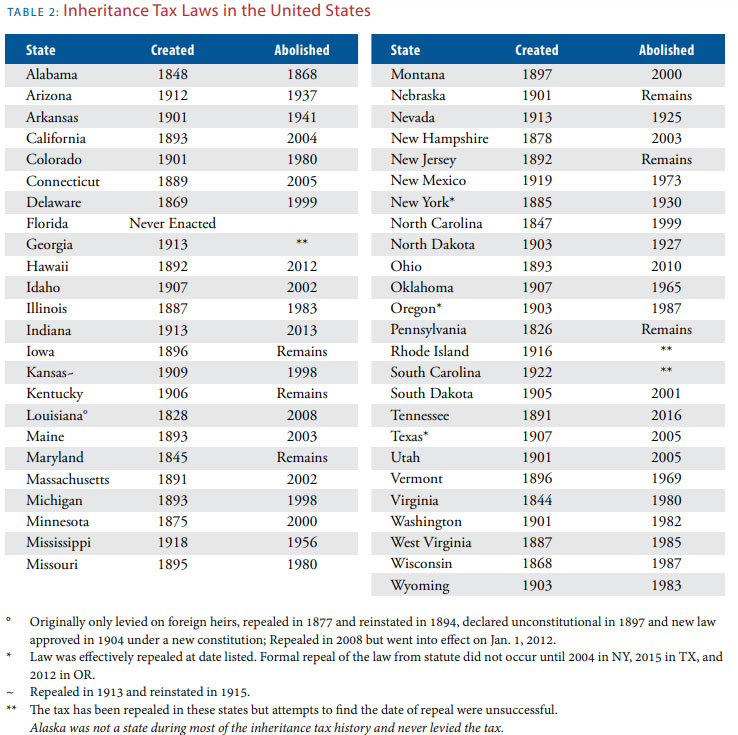

Death And Taxes Nebraska S Inheritance Tax

Louisiana Packet To Appoint Natural Tutor Under Tutor To Child Us Legal Forms

Estate Taxes New Orleans Orleans Parish Louisiana Lawyer Attorney Law Firm

Louisiana Inheritance Laws What You Should Know Smartasset

Free Louisiana Power Of Attorney Forms Pdf Word Downloads

10 Ways To Reduce Estate Taxes Findlaw

Individuals Louisiana Department Of Revenue

Fill Free Fillable Louisiana Real Estate Commission Pdf Forms

Probate Fees In Louisiana Updated 2021 Trust Will

Understanding Succession In Louisiana Scott Vicknair Llc

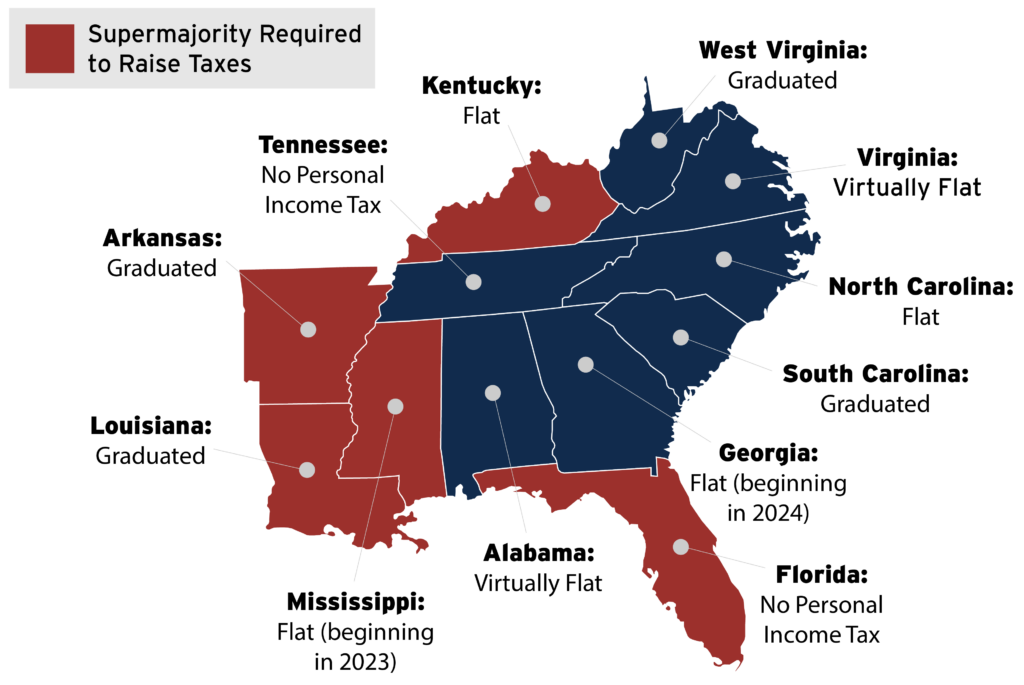

Creating Racially And Economically Equitable Tax Policy In The South Itep